Sydney | September 30, 2025

A New Trade Shock for Australian Pharma

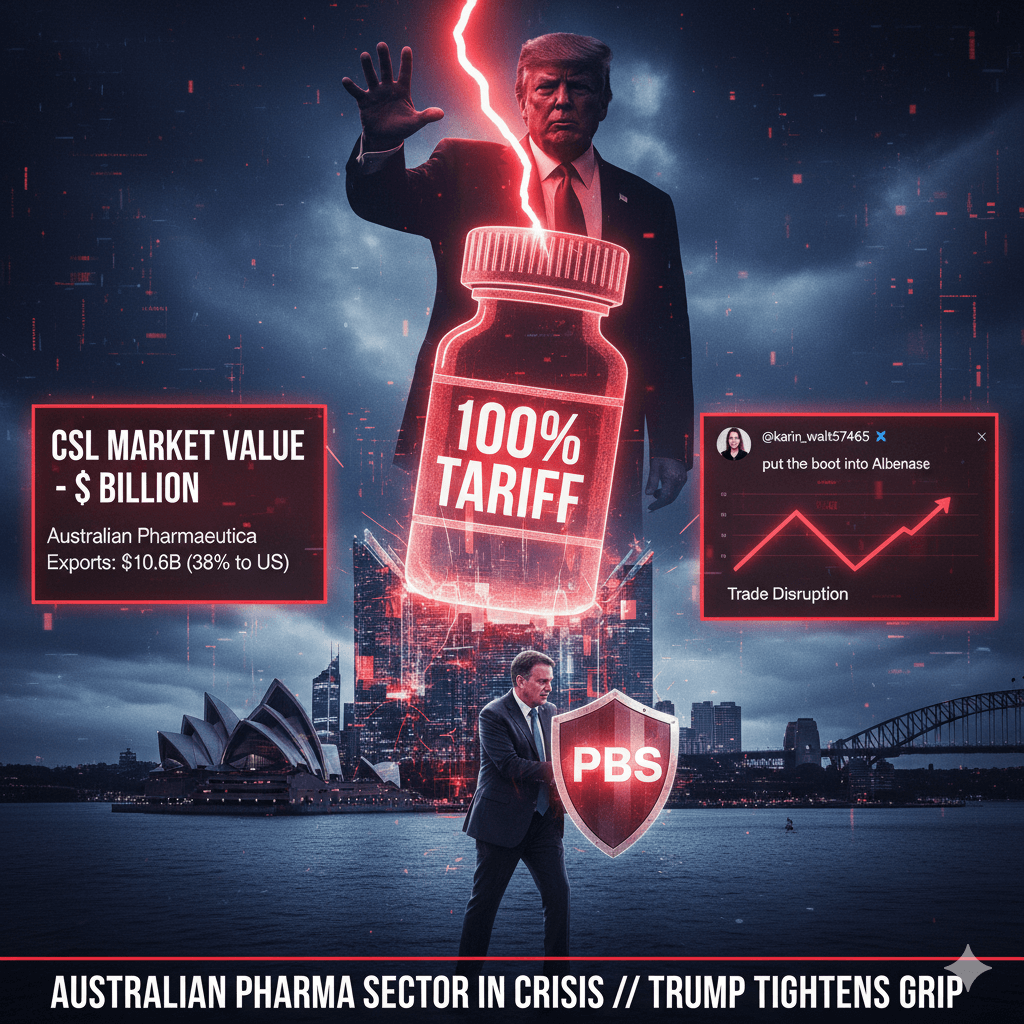

The Australian pharmaceutical industry is bracing for heavy losses after U.S. President Donald Trump imposed 100% tariffs on imported pharmaceutical goods, effective October 1. Announced during a White House press briefing on September 26, the decision is the latest in a string of protectionist measures aimed at reviving U.S. manufacturing — and it’s already sending shockwaves through global markets.

Melbourne-based CSL Limited, one of Australia’s largest biotech firms, saw its market capitalization plunge by nearly A$1 billion within hours of the announcement. Investors fear that export disruptions could devastate one of Australia’s few globally competitive manufacturing sectors.

The Trump administration’s move follows similar tariffs on steel and aluminium (50%) introduced in June and a 10% levy on imported medicines in April 2025, under Section 232 of the U.S. Trade Expansion Act. While the White House argues these steps are vital to rebuild domestic supply chains, Australian producers say they amount to economic sabotage.

“This is a political decision disguised as industrial policy,” said Professor Jane Mackinnon, a trade economist at the University of Sydney. “Australia’s biotech sector is being punished despite our long-standing defence and trade alliance.”

An Industry on the Edge

Pharmaceutical exports are a A$10.6 billion industry, making Australia one of the top-ten exporters of biological medicines and vaccines. The United States accounts for 38% of those exports — around A$4 billion annually, according to the Department of Foreign Affairs and Trade (DFAT).

Of that, A$2.2 billion comes from plasma-derived products manufactured by CSL Behring, including treatments for haemophilia and immune deficiencies. Any interruption threatens both Australian jobs and global medical supply chains.

CSL confirmed it has sought a five-year phase-in period for the tariffs and exemptions for specialised biotech equipment, citing the risk of major disruptions to U.S. healthcare providers that rely on Australian exports.

In an interview with Reuters, CSL CEO Paul Perreault warned:

“If these tariffs are applied unilaterally, the consequences will ripple through hospitals and research labs on both sides of the Pacific.”

Government Response

Prime Minister Anthony Albanese responded swiftly, stating Canberra would pursue “all diplomatic and trade avenues” to protect local manufacturers. He also reiterated that the Pharmaceutical Benefits Scheme (PBS) — Australia’s taxpayer-funded medicine subsidy program — “will remain untouched by foreign pressure.”

Health Minister Mark Butler said his department was working with U.S. officials to explore exemptions under bilateral trade agreements.

“Our message is clear: we will defend Australian science, Australian jobs, and Australian innovation,” Butler told the ABC’s Insiders program on Sunday.

However, critics argue Albanese faces an uphill battle against Trump’s assertive trade stance. Opposition Leader Peter Dutton accused the government of being “caught flat-footed,” while industry figures fear the dispute could spill into broader trade relations.

Case Study: CSL’s Global Network at Risk

CSL’s plasma products rely on a complex global supply chain. Plasma is collected across the U.S., processed in Australia and Switzerland, and then exported back to North America. Any tariff barriers could derail this ecosystem.

A 2024 study by the Grattan Institute found that over 6,000 Australian jobs depend on pharmaceutical exports to the United States. With U.S. imports now effectively doubling in price, analysts fear buyers will turn to European or domestic alternatives.

Social Media and Public Reaction

On X (formerly Twitter), user @karin_walt57465 posted that the government should “put the boot into Albanese” for failing to anticipate the tariffs, garnering over 1.2 million views in 24 hours. While the post sparked debate, analysts caution against politicising an issue that spans multiple administrations.

“Trump’s economic nationalism is not new — it’s part of a long-term recalibration of U.S. trade policy,” explained Dr. Michael Fullerton from the Lowy Institute.

Broader Economic Implications

The tariffs come amid growing global scepticism of free trade. Economists at The Guardian’s business desk note that pharmaceutical supply chains have become a key geopolitical lever, with Western nations seeking “health sovereignty” post-pandemic.

Australia, meanwhile, is caught between preserving its export markets and maintaining diplomatic goodwill with Washington. The Organisation for Economic Co-operation and Development (OECD) warned that escalating trade barriers could shave 0.4 percentage points off Australia’s GDP growth next year.

Looking Ahead

Trade negotiations are expected to resume in early October. If exemptions are not granted, analysts forecast long-term damage to Australia’s biotechnology competitiveness, particularly in the global vaccine market.

Despite the immediate market shock, industry insiders say the crisis could accelerate diversification.

“We’ve depended on one market for too long,” said Dr. Allan Reese, CEO of the Australian Biomanufacturing Council. “This may finally push us to expand into Asia and Europe.”