October 8, 2025 | Sydney, Australia

A Controversial Funding Decision

Australia’s contribution to a Chinese renewable energy project has ignited fierce debate, with critics claiming taxpayer dollars are being diverted overseas while domestic energy bills soar.

According to the Asian Development Bank (ADB), a total of $13.6 million in Australian funds—part of Canberra’s long-term investment in regional development—has gone toward the $600 million “Shandong Green Development Fund Project”. The initiative aims to retrofit 30,000 rural homes in China’s Shandong Province with energy-efficient heat pumps and establish a biomass power plant to cut local emissions.

The ADB defends the project as part of its Strategy 2030, focusing on climate resilience, livable cities, and gender equality. However, economists and public policy analysts argue that funding a project in the world’s largest coal-producing nation contradicts Australia’s own energy priorities.

“It’s a vain attempt to decarbonise a nation that continues to expand coal capacity,”

said Zoe Hilton, Senior Policy Analyst at the Centre for Independent Studies (CIS).

“Australians are effectively subsidising the carbon transition of a country outpacing us in fossil fuel development.”

Policy Context and Fiscal Impact

Australia has been an ADB shareholder since 1966, contributing over $1.4 billion in total. The ADB asserts that each member’s share is used to promote sustainable economic growth across the Asia-Pacific. But the optics of sending funds to China—now the world’s second-largest economy—have caused political backlash.

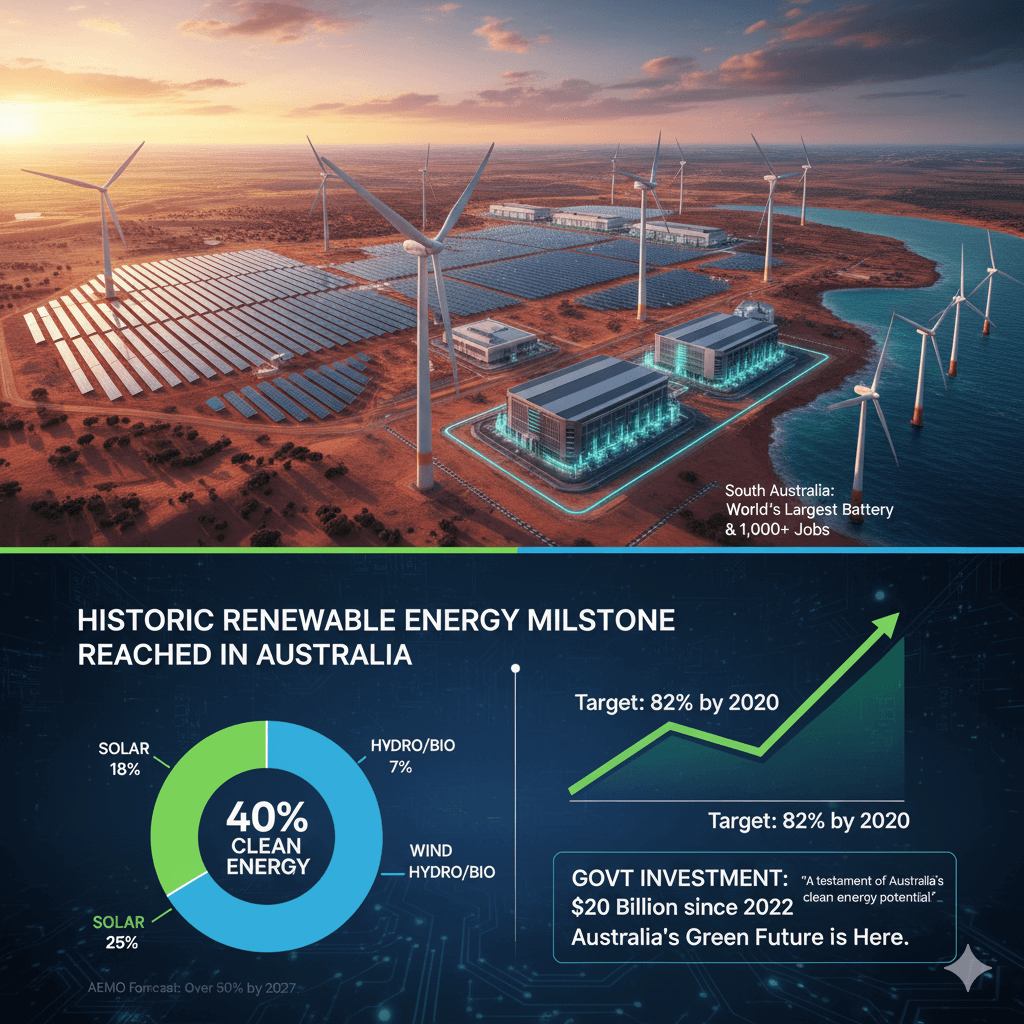

Treasury figures show Australian households already face record-high energy costs. According to the Australian Energy Market Operator (AEMO), average residential electricity prices have risen 34% since 2021, despite a decade-long $29 billion investment in local renewables.

Daniel Wild, Deputy Executive Director at the Institute of Public Affairs (IPA), has called for a public audit of the ADB’s funding practices.

“Taxpayers deserve to know why their money is being used to fund a Chinese biomass plant instead of supporting regional Australian communities,”

Wild said in an interview with Sky News Australia.

Government Response and Political Reactions

The Albanese government has defended Australia’s role in the ADB, describing it as a crucial pillar of regional diplomacy and economic cooperation. Treasurer Jim Chalmers said the funding aligns with the government’s “commitment to regional climate partnerships.”

However, Opposition Leader Peter Dutton labelled the investment “tone-deaf,” arguing that it undermines domestic priorities amid cost-of-living pressures.

“When pensioners in Perth and farmers in Dubbo are struggling with power bills, the last thing Australians want is to hear they’re funding Chinese infrastructure,”

Dutton told The Australian Financial Review.

The controversy follows Canberra’s recent pledge of $492 million to the ADB’s Asian Development Fund 14, which supports climate adaptation projects in developing nations. Critics question whether China—a country with $3 trillion in foreign reserves—should qualify as a recipient of development finance.

Economic Analysis and Case Study

A case study by the Lowy Institute on multilateral lending to upper-middle-income nations notes that projects like Shandong’s “often reflect political alignment rather than financial necessity.”

Indeed, China’s domestic investment in renewables dwarfs ADB involvement: it spent US$676 billion on green energy projects between 2020 and 2024, according to Bloomberg NEF. Yet, ADB participation gives the initiative international legitimacy and shared accountability.

Economist Dr Kara Thompson from the University of Sydney argues the move highlights a broader issue in global climate financing:

“We’re seeing wealthier nations indirectly funding geopolitical rivals through multilateral channels. It’s economically rational for China but politically risky for Australia.”

Public Opinion and Transparency Concerns

Public sentiment in Australia has been mixed. Online forums and opinion pieces show frustration that foreign aid budgets continue to grow while domestic infrastructure lags behind. The Department of Foreign Affairs and Trade (DFAT) confirmed that no direct payments were made to China, but rather through pooled funds within the ADB.

Still, taxpayers remain sceptical. Calls for greater transparency have intensified after media reports—first aired by Sky News Australia on October 8 2025—highlighted the spending connection.

“We’re past the renewable honeymoon,” said Hilton. “Australians support clean energy, but they also expect fiscal responsibility.”

Looking Ahead

The ADB insists that the Shandong project will deliver measurable emission reductions and serve as a “blueprint for scalable climate solutions” in Asia. Yet questions linger over the accountability of cross-border green investments.

As Australia prepares to co-host the 2026 Asia-Pacific Climate Finance Summit, the debate underscores a difficult balance: global environmental leadership versus national economic responsibility.