October 13, 2025 – Sydney, Australia

Government Backflip Eases Pressure on Working Australians

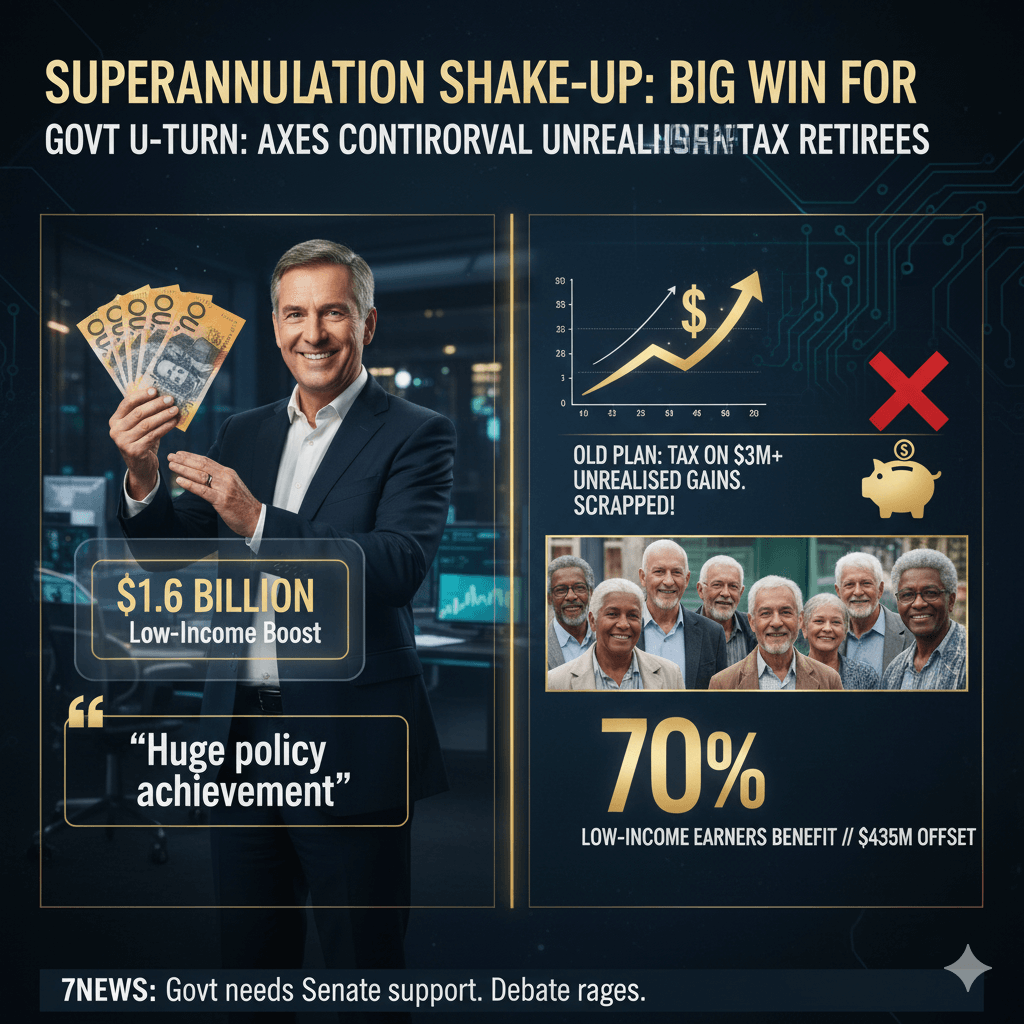

More than a million of Australia’s lowest-paid workers are set to benefit after Treasurer Jim Chalmers announced a dramatic U-turn on the government’s controversial plan to tax unrealised superannuation gains on balances exceeding $3 million.

The Albanese government confirmed the reversal during a press conference on Monday, in what analysts are calling one of the most significant economic pivots since 2022.

According to a 7NEWS Australia report, the revised super plan will raise $1.6 billion in its first financial year (2028-29) and includes a $435 million Low-Income Superannuation Tax Offset (LISTO) to assist part-time and lower-income earners.

Former Labor Prime Minister Paul Keating, who introduced Australia’s modern super system in the 1990s, hailed the change as a “huge policy achievement,” describing it as a necessary correction to restore fairness and simplicity to the retirement system.

Political Backflip Sparks Debate

The decision has divided Canberra.

Opposition Treasurer Ted O’Brien described the move as “a win for everyday Australians”, while the Greens labelled it a “gift to the super-rich.”

Coverage from News.com.au notes that the Albanese government will now need cross-bench support in the Senate to pass the legislation—no small feat, given Treasury’s modelling revisions tabled during recent hearings.

Prime Minister Anthony Albanese dismissed speculation of political weakness, insisting that “our long-term goal remains a fair, progressive and sustainable superannuation system.”

Still, the timing of the reversal—coming months before the May 2026 Budget—suggests the government bowed to pressure from both internal party factions and public-sector unions concerned about retirement security.

Economic and Social Impact

Data from the Australian Institute of Superannuation Trustees (AIST) shows that 70 percent of super balances under $500,000 belong to the bottom half of income earners.

This means the revised plan is likely to disproportionately benefit low- and middle-income Australians.

AIST CEO Eva Scheerlinck praised the change in an interview with The Guardian, saying:

“This policy acknowledges that retirement savings are not luxury assets—they’re essential buffers against poverty in old age.”

Independent economic modelling suggests the new framework could add $3,200–$4,500 to the lifetime savings of Australians earning below $70,000 a year.

Expert Commentary and Case Study

Economist Dr Rachel Fong of the University of Melbourne notes that “reforms like these enhance participation and confidence in the super system, especially among women and casual workers.”

Case Study – Port Macquarie Aged-Care Worker

Julie Norton, 62, says she felt “genuinely relieved” by the announcement.

“I’ve worked for 40 years in part-time care jobs and never earned enough to max my super. Knowing the government isn’t punishing small savers makes a difference.”

According to the Treasury, more than 1.2 million Australians fall into similar brackets, earning less than $60,000 and contributing under $4,000 per year to super.

Challenges Ahead

Critics warn the reversal could create short-term fiscal gaps.

The Parliamentary Budget Office projects a $900 million drop in forecast revenue compared to the previous plan.

However, analysts like Dr Fong argue that greater participation and voluntary contributions will offset losses over time.Meanwhile, business groups including the Australian Chamber of Commerce are calling for complementary reforms—such as increased flexibility for self-employed Australians and expanded concessional contribution limits.

Looking Ahead

The Senate debate will determine whether this reform becomes law before 2026.

If passed, Treasury forecasts that renewed investment confidence could boost retirement balances by 3–4% within five years.The move repositions Australia’s superannuation policy as one of the world’s most inclusive—reinforcing the nation’s long-term commitment to equitable economic growth.